Our Investment Philosophies form an integral part our core values, beliefs and investment principles.

We put you,

our client first,

always...

EQUITIES, FIXED INCOME & ALTERNATIVES

Our Investment Philosophies form an integral part our core values, beliefs and investment principles.

WE PUT YOU,

OUR CLIENT FIRST,ALWAYS...

EQUITIES, FIXED INCOME & ALTERNATIVES

OUR CORE PRIVATE equity Philosophy

The Relentless Pursuit of Value Creation

Irrespective of Market Cycles

Value creation is the backbone of core Private equity philosophy.

Anneau’s investment philosophy as it seeks to make control or control-oriented privately negotiated acquisitions of high quality companies for its investors.

We intend to remain a disciplined, value-oriented investor with a focus on building our portfolio companies through superior private equity-style governance (operating intervention, quick decision making, long-term orientation, operational enhancements, Brand equity strengthening, etc.).

We aim to provide our Limited Partners with access to attractive investments in great companies generated from our extensive deal sourcing network. We thereon leverage all of Anneau’s value creation capabilities in seeking compelling long-term compounding of MOICs and so wealth creation.

In private equity, we strive to generate superior risk-adjusted returns relative to public market equities.

The following are some of our key private investment focus:

1. We focus on the long-term fundamentals of the business in which we invest. We will not be distracted by over focusing on shorter-term goals such as quarterly earnings and shall remain focused on building significant, long-term value for our portfolio companies and so for our investors.

2. We benefit meaningfully from the expertise of Anneau’s senior management, each of its business segments and its advisory network of experienced industry executives.

3. We require close coordination and incentive alignment between management, the board and shareholders of our portfolio companies

Anneau targets attractive returns over an anticipated holding period of 7-10 years. We further aim to prioritise the optimisation of the Capital structure of our Portfolio companies through the use of relevant financial instruments.

OUR PRIVATE EQUITY INVESTMENT APPROACH

Our core Investment approach revolves around the following:

1. Consistent and Disciplined Investment Process;

2. Industry focused;

3. Variable Deal sizes;

4. Control & influence oriented;

5. Driving Value creation; and

6. Pursuing Exit Alternatives

KEY INVESTMENT APPROACH METRICS

We pay particular attention to the key metrics listed hereunder in formulating our investment decision:

1. Asset Allocation (Africa, including Mauritius is a 54-country fragmented market with vastly different macro and micro dynamics)

2. Growth (We tend to favour stable and predictable EBITDA growth supported by attractive market fundamentals, strong company competitive advantage, market positioning, a demonstrated track record of historical growth and attractive shareholder returns)

3. Cash Flow (Initial Unlevered cash flow supported by high free cash flow conversion and attractive unlevered yields)

4. Leverage (Risk Adjusted Leverage amplifies Risk Adjusted returns driven by strong underlying unlevered returns. We pre-determine the leverage duration and sensitivity prior to any investment decision)

5. Exit Multiple (Returns tend to be relatively less sensitive to Exit multiples as Multiples compression is amortised with long investment holding duration)

PRIVATE equity investment process

The Relentless Pursuit of Value Creation

Irrespective of Market Cycles

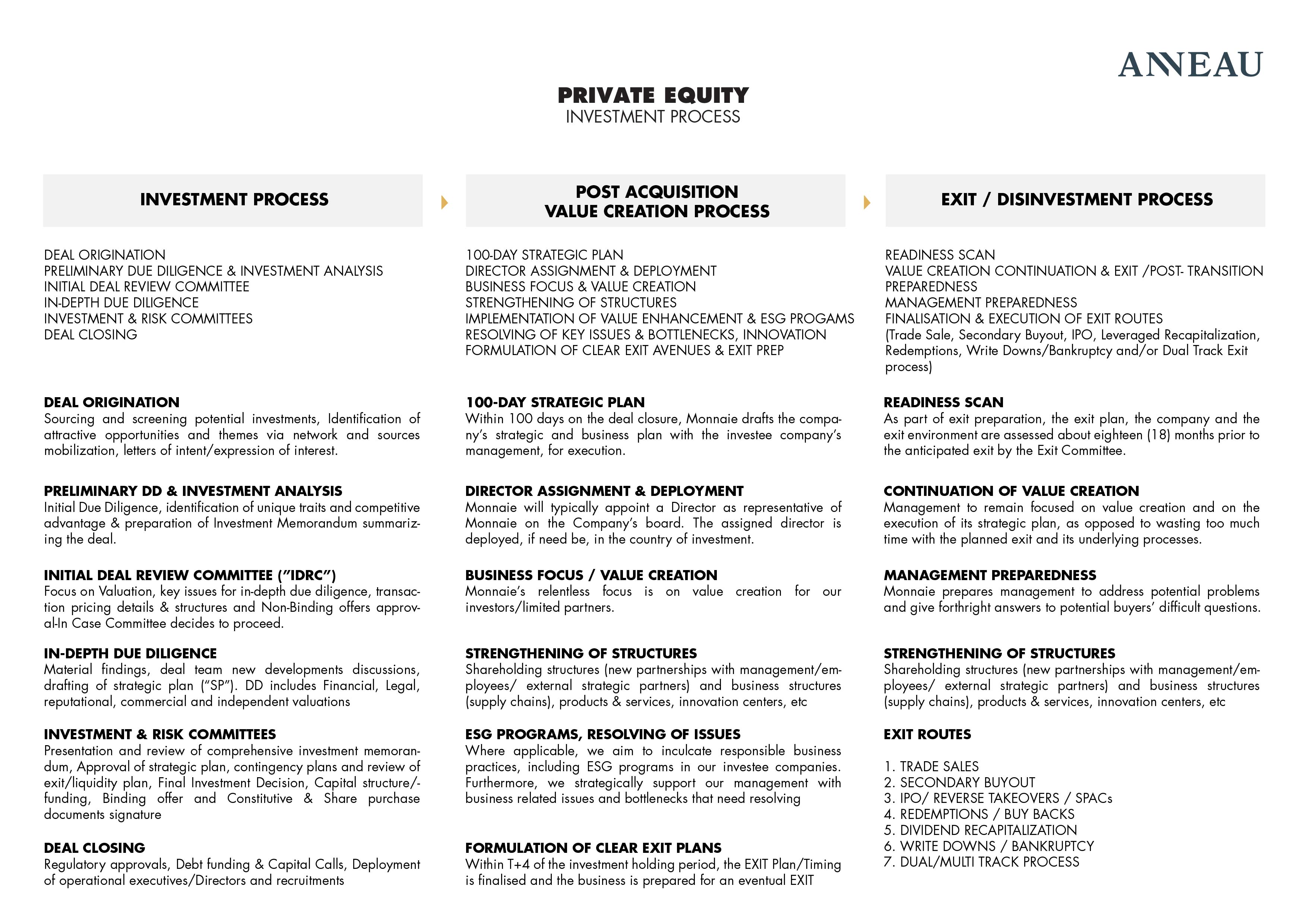

Our Private Equity Investment process can be summarised as per hereunder:

1. Deal Origination (Sourcing and screening potential investments, identification of attractive opportunities and themes via network and sources mobilisation, letters of intent/expression of interest)

2. Preliminary Due Diligence and Investment Analysis (Initial Due Diligence, identification of unique traits and competitive advantage & preparation of Investment Memorandum summarising the deal)

3. Initial Deal Review Committee (Focus on Valuation, key issues for in-depth due diligence, transaction pricing details & structures and Non-Binding offers approval- In Case Committee decides to proceed)

4. In Depth Due Diligence (Material findings, deal team new developments discussions, drafting of strategic plan (“SP”)

5. Investment & Risk Committees (Presentation and review of comprehensive investment memorandum, approval of strategic plan, contingency plans and review of exit/liquidity plan, Final Investment Decision, Capital structure/funding, Binding offer and Constitutive & Share purchase documents signature)

6. Deal closing (Regulatory approvals, Debt funding & Capital Calls, Deployment of operational executives/ Directors and recruitments)

POST INVESTMENT & VALUE CREATION PROCESS

Anneau fundamentally believes that our ‘true’ work in Private equity starts here, once the acquisition is complete, when it is TIME to CREATE VALUE in the business that has been acquired for our partners/ clients/ investors.

Anneau’s post investment and Value creation process can be summarised as hereunder:

1. Implementation of 100-day strategic plan (The strategic plan is refined with the Executive Management within the first 100 days of company on-boarding. KPIs are defined and monitored)

2. Deployment of Anneau’s Investment professionals in the country/company for on the ground support

3. Focus on growth (Organic & Inorganic), costs, processes, product/service offering and customer service delivery optimisation

4. Strengthening of Shareholding structure via new partnerships, where applicable

5. Implementation of ESG enhancement programs

6. Resolving of Issues and bottlenecks

7. Formulation of clear Exit avenues

EXIT / DISINVESTMENT PROCESS

At the beginning of every deal, Anneau’s Investment Committee already agrees on a pre-Exit vision incorporating both the preferred exit route and timing of the exit. At Anneau we discipline ourselves to regularly revisit this exit vision—often every six (6) months and/or as often as necessary—through the duration of the holding period, as the constellation of influencing factors is always in flux.

In addition to frequent checks against the original exit strategy, Anneau undertakes four (4) critical activities that we believe tend to lead to a successful exit for our investors and/or limited partners:

1. Readiness Scan

2. Value creation continuation & Exit/Post-Transition preparedness

3. Management Preparedness

4. Finalisation & execution of Exit Routes

Anneau’s private equity investment process can be summarised as per hereunder:

ASSET CLASSES SPECIFIC PHILOSOPHIES

Learn more on our Investment Philosophy for the multitude of Asset Classes that we invest in.

As Multi Assets Investment Managers, we invest in Publicly Listed Equities, Fixed Income and Alternatives.

Public Equities

Public equities are investments in publicly listed companies, both locally, regionally and internationally.

Fixed Income

Fixed Income refer to investments in the Debt issued by Mauritian and Sovereign Governments, Supra-nationals and corporate bodies.

our RISK MANAGEMENT philosophy

Learn more about our Risk Management Management Philosophy.

Our Risk Management Philosophy is focused on Risk Minimisation and the maximisation of Risk Adjusted Returns.

Our Risk Management Philosophy

Our Risk Management Philosophy is founded on the relentless pursuit of risk minimization in view of preserving our clients’ capital and widening their risk return spread.