Our Investment Philosophies form an integral part our core values, beliefs and investment principles.

We put you,

our client first,

always...

EQUITIES, FIXED INCOME & ALTERNATIVES

Our Investment Philosophies form an integral part our core values, beliefs and investment principles.

WE PUT YOU,

OUR CLIENT FIRST,ALWAYS...

EQUITIES, FIXED INCOME & ALTERNATIVES

CORE FIXED INCOME INVESTMENT PROCESS

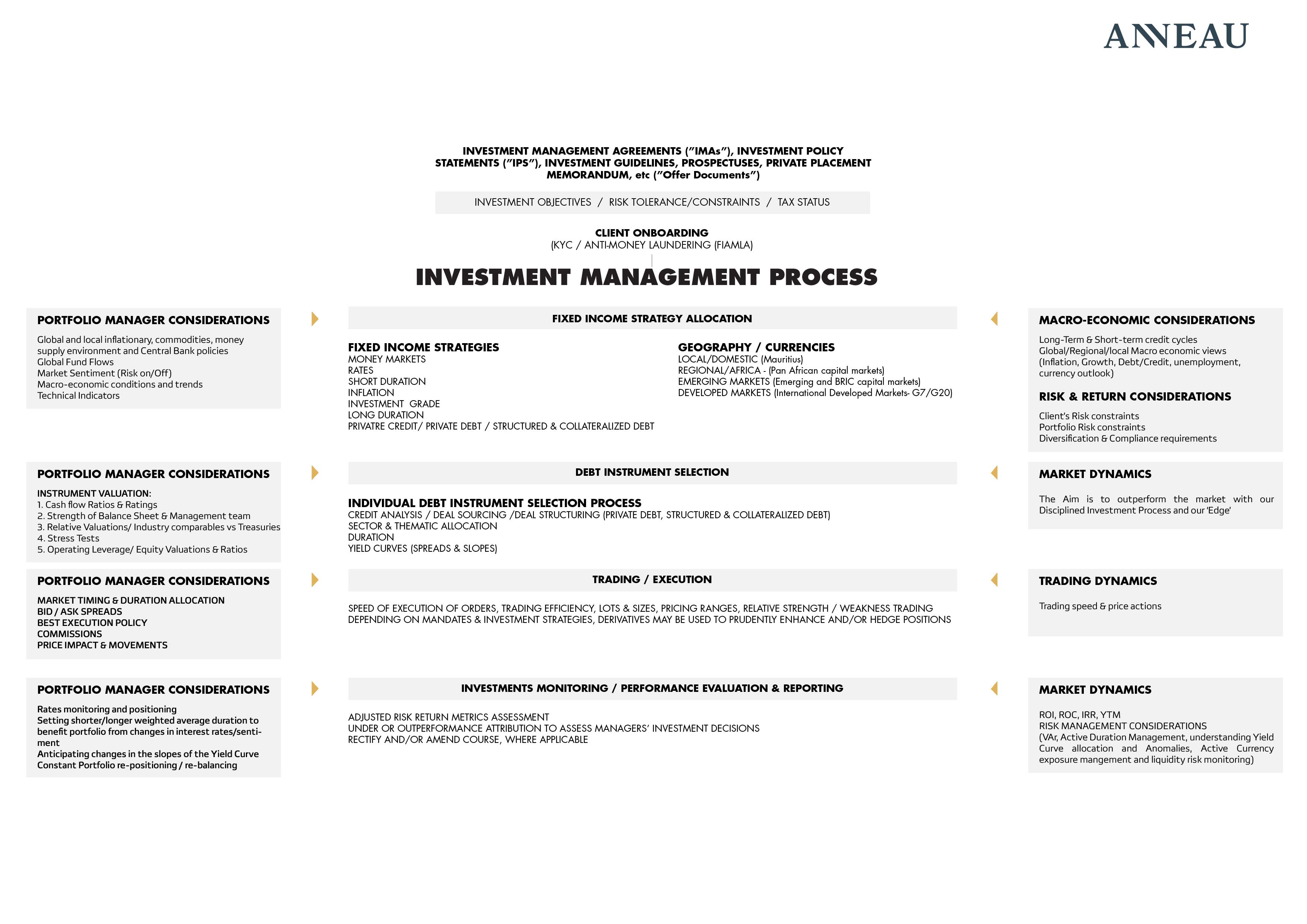

Our Rigorous Investment process is founded on fundamental bottom-up, top-down and technical research and analysis.

These assist us in identifying and targeting the most attractive fixed income opportunities for our clients’ portfolios.

Anneau’s Fixed Income investment process has evolved over years and has been tested in very difficult market environments.

It integrates insights from our Investment Committees and research teams, which anticipate market and economic trends over the coming six (6)- twelve (12) months (.i.e. the short-term credit cycle) and projects trends over the coming three (3) to five (5) years and beyond (.i.e. the long-term credit cycle).

These top-down views are complemented by bottom-up perspectives (credit analysis) from specialists and quantitative analysis of individual securities and portfolio construction. The Investment Committee, which is composed of senior investment professionals, drives decision-making on a daily basis.

The fixed income team aims to use platforms with highly integrated global trading and portfolio management capabilities. Our strong in-house research capabilities and our execution network, amongst others, underpin all fixed income investment activities thereby enhancing execution quality and reducing operational as well as reinvestment risks.

In an environment of reduced liquidity where corporate bond inventories at primary dealers are sharply below where they were several years ago, our specialist fixed income teams should work, where applicable, with investment banks to source fixed income securities directly from issuers, where possible. This meets client needs for new issues, allows customisation and produces intelligence on trends.

Anneau’s Fixed Income Investment Process can be summarised in the following chart:

OUR CORE fixed income Philosophy

Arbitraging Credit Cycles

Irrespective of Market and Economic Cycles

Anneau’s Fixed Income Philosophy is founded on our belief that the global monetary and fractional reserve banking systems are structured such that they inherently create short-term and long-term credit cycles; with varying opportunities and challenges.

Our Philosophy is to always profoundly analyse and understand different fixed income securities and markets, their current cyclical positioning in both these cycles and thereon position our portfolios in view of preserving and growing our clients’ capital and fixed income allocation. In order to deliver sustainable and consistent industry leading excess returns to our fixed income clients over different credit and economic cycles, we rely significantly on our robust fixed income investment process; whose main objective is to preserve capital and enhance yield (which is the essence of fixed income investments).

Our robust risk management philosophy ensures that risk mitigation and control is at the heart of our fixed income strategies. Its objective is to preserve capital while enhancing income/yield. Our risk management process focuses on credit, interest rates, reinvestment and event-driven risks. Our research is based on fundamental credit analysis and macro-economic research (including credit analysis focused on credit worthiness, credit quality and relative value, interest rates, currencies, amongst others). These sound processes reinforce our confidence in our ability to actively manage our duration targets in enhancing our portfolios’ risk return spreads.

Anneau’s active fixed income strategies stretch across a range of investment styles and segments of the fixed income universe (primarily credit and debt), including Global, Local, African, Emerging markets debt, Corporate credit, Sovereign bonds and loans). Our portfolios employ an investment process which is research driven and blends disciplined portfolio construction with regular risk and performance review.

Similar to our equity strategies, Anneau’s Fixed income philosophy can be segregated into the following two (2) credit cycles and their corresponding strategies:

1. LONG TERM CREDIT CYCLE AND STRATEGIC FIXED INCOME PORTFOLIO STRATEGY

(LONG DURATION STRATEGY)

Anneau’s strategic fixed income allocation is based on our research and analysis of longer-term credit cycles and our inherent ability to follow the various shorter-term credit cycles within these long-term credit cycles of booms and bursts. Our longer-term allocation, where applicable, uses fixed income ETFs and/or buying and holding the main issues and index constituents with the sole purpose of delivering market returns or Beta.

In which case, we shall use index strategies seeking to closely track the returns of a corresponding index, generally by investing in substantially the same underlying securities within the index or in a subset of those securities selected to approximate a similar risk and return profile of the index. Our Beta fixed income solutions span across the debt universe and is aimed to help our clients access and manage exposure to the local, regional (African) but also global (including emerging markets) bond markets.

Our portfolio construction process entails detailed benchmark knowledge, efficient trading, and performance analysis. Daily updates from index providers keep us abreast of new securities and any index methodology changes.

2. SHORT-TERM CREDIT CYCLE AND TACTICAL FIXED INCOME PORTFOLIO STRATEGY

(SHORT DURATION STRATEGY)

Our team adopts a model-integrated approach to active fixed income that combines the insights of our people with a quantitative research platform to generate high quality alpha across fixed income asset classes.

The distinguishing feature of Anneau’s fixed income investment management style is the ability to generate alpha within a risk-managed framework. Real-time analysis of a vast array of risk measures allows assessment of the potential impact of various strategies on total return. Most importantly, at Anneau, our tactical approach to Alpha creation is our ability to focus on the technicals of the securities, the issuers and the pricing. Over the years, we have understood that policies and regulatory factors often lead to mis-priced risk premia and so the resulting opportunities in embedded options.

Our ‘edge’ revolves around our ability to factor in these mis-pricing and so to tactically select and hold only the most attractive bonds for our tactical portfolio positioning.

Our professionals identify unrecognised value in the fixed income markets through rigorous proprietary fundamental research that balances bottom-up research analysis with top-down investment themes.

Macro-economic and credit researches are essential to our portfolio construction process. The investment decisions are further based on issuer and security selection, sector rotation, duration and yield curve strategies as well as currency strategies, where applicable. Our specialist fixed income team has developed the expertise to offer clients access to a range of opportunities in debt (whether public of private).

OUR FIXED INCOME STRATEGIES

Diversified exposure along the yield curve

Taking advantage of mis-pricing through credit cycles

ANNEAU’S FIXED INCOME STRATEGIES

Hereunder is a list of fixed income strategies managed by Anneau:

- Money Markets

- Rates

- Short Duration

- Inflation

- Investment Grade

- Long Duration

- Private credit/Private Debt/Structured & Collateralised Debt

These strategies are used for the following geographical exposures:

- Local (Domestic)

- Regional (Africa)

- Emerging Markets

- Global / Developed Markets (G7/G20)

ANNEAU’S FIXED INCOME FUNDAMENTAL RESEARCH

Anneau’s specialist Fixed Income team relies on extensive internal and external research to frame its broad view on the outlook for different asset classes (including the fixed income asset class) and global markets. Given the interconnectivity and linear/non-linear correlation of various asset classes with the global macro-economy, global geopolitics, socio-politics and socio-economics; as an Investment Manager, this information and a deep understanding of these factors form the foundation of our Investment research.

We use external information provided by the World Bank, the IMF, International Bank of Settlements, central banks, exchanges, data providers, Think Tanks, Research houses, brokers, investment banks, investment specialists, personal interviews, conferences, seminars, economic forums and other publicly available information.

Our specialist fixed income team further draws views, outlooks and recommendations from our Equity, Alternatives as well as Multi Assets teams for a broader perspective of asset class conditions. These provide them with an intelligent platform to understanding, collecting, analysing and interpreting a vast amount of information directly and/or indirectly impacting fixed income investments. The team further uses various quantitative and econometric models to analyse vast amounts of systematically important information regarding economic and market data which provide signals on technical factors (such as market liquidity, credit conditions, momentum, relative strength and valuations).

With Central bank policies having been an overly determinant of global money supply and capital markets movements since the financial crisis until now, at Anneau, our Fixed income team constantly track monetary policy developments, macro cyclical factors as well as other leading sentiment indicators.

These indicators can generally be summarised under the following sets:

POLICIES

- Forward guidance (monetary policies)

- Fiscal policies

- Inflation expectations, forecasts and developments

- Trade policies and BOPs

- Interest rates (including forwards)

- Quantitative easing and tightening

CREDIT CYCLES (LONG-TERM & SHORT TERM)

- Long-term credit cycle

- Short-term credit cycle

- Stages of economic, capital markets and credit cycles (early, mid and late cycles)

- Inflation cycles (including PPIs & PMIs)

- Consensus forecasts and estimates

- Consumer cycles (consumer confidence surveys, producer confidence surveys, etc.)

SENTIMENTS

- Options pricing

- Fund flows

- Fast money versus Real money

- Business and confidence surveys

Credit analysis and financial analysis models are used to analyse various issuers and issues in our universe. The team can thereon support, question and so amend its qualitative ideas where need be and most importantly when making judgement calls on the specific asset class. This is a very critical step in our investment process as irrespective of the credit agencies’ or banks’ and/or financial institutions’ assessments of a particular issuer, we at Anneau thoroughly analyse our potential investments. This provides us with a sense of comfort, allows us to frame a high conviction view but also relate to our fiduciary responsibilities and our investment philosophies.

The Fixed Income team will further consider:

- Sector/Thematic viewpoints and allocation;

- Duration positioning; and

- Yield curves positioning (including credit spreads and curve slopes)

Our ‘edge’ is therefore a result of thorough, in-depth research for which we believe few if not none alternatives exist.

ASSET CLASSES SPECIFIC PHILOSOPHIES

Learn more about our Investment Philosophy for the multitude of Asset Classes that we invest in.

As Multi Assets Investment Managers, we invest in Publicly Listed Equities, Fixed Income and Alternatives.

Alternatives

Alternatives include Private Equity, Infrastructure, Energy, Real Estate/Property- REITS, Commodities and Hedge Funds.

Public Equities

Public equities are investments in publicly listed companies, both locally, regionally and internationally.