Our Investment Philosophies form an integral part our core values, beliefs and investment principles.

We put you,

our client first,

always...

EQUITIES, FIXED INCOME & ALTERNATIVES

Our Investment Philosophies form an integral part our core values, beliefs and investment principles.

WE PUT YOU,

OUR CLIENT FIRST,ALWAYS...

EQUITIES, FIXED INCOME & ALTERNATIVES

OUR CORE EQUITY INVESTMENT PROCESS

Our Rigorous Investment process is founded on fundamental bottom-up, top-down and technical research and analysis.

These assist us in identifying and targeting the most attractive opportunities for our clients’ portfolios.

Anneau tend to favour a specialist approach using a team of asset class and sector specialists. We spend years in identifying investment securities across the globe and across capital structures for our clients. We also draw on our robust risk management framework, a highly skilled trading desk and decades of industry-leading investment expertise to offer our clients industry leading risk adjusted excess returns.

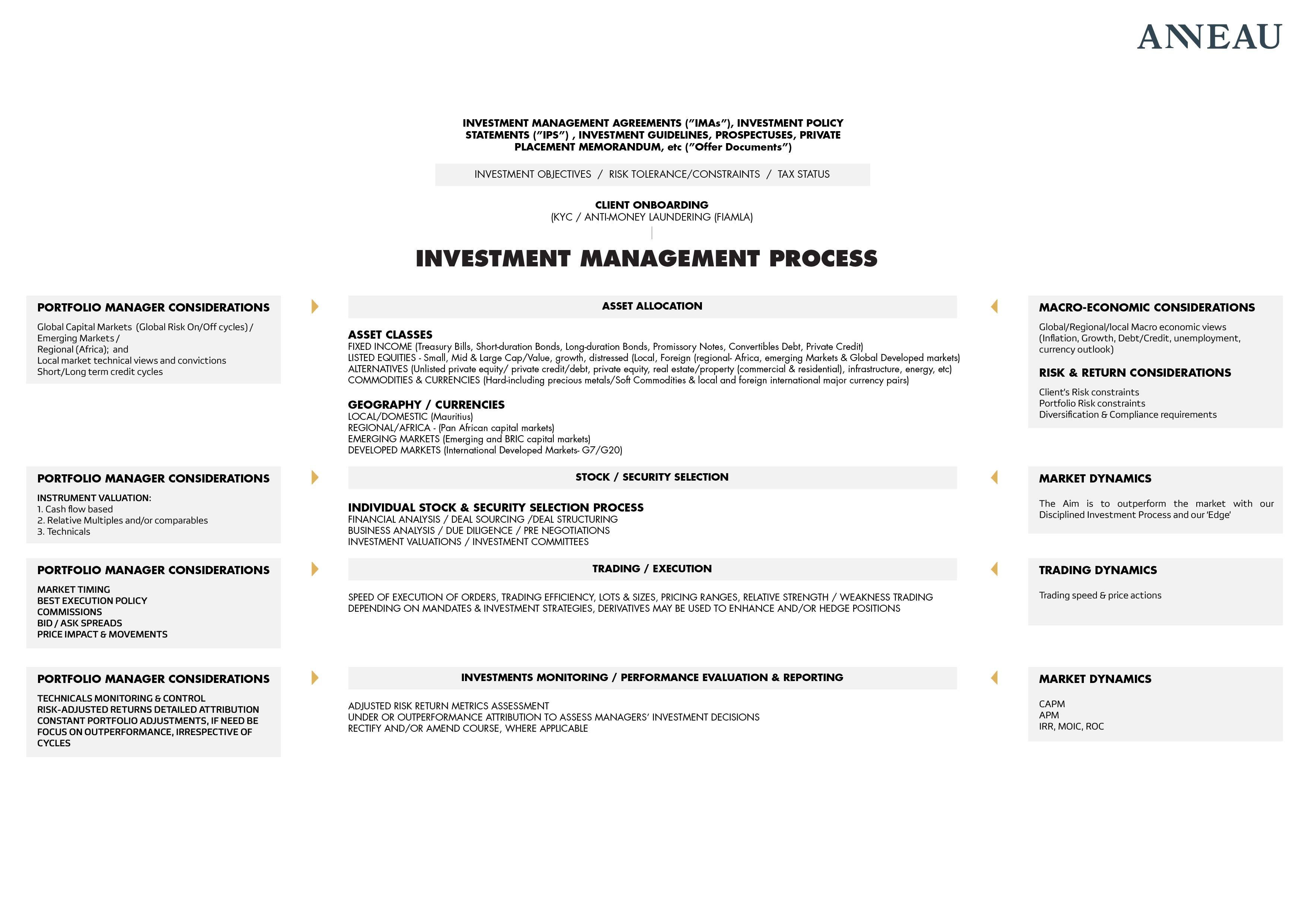

Anneau’s Investment process is depicted in the chart below:

OUR CORE equity Philosophy

The Relentless Pursuit of Alpha

Irrespective of Market Cycles

Our Core equity Investment philosophy is driven by the pursuit of Alpha, irrespective of economic cycles.

We believe that a portfolio of high quality, robust, innovative, customer caring, problem resolving companies; managed by a fully dedicated management team with a focus on growth and efficiency tend to outperform more modest ones over the long term.

Given short term market cycles and volatility which create mis-pricing opportunities, Anneau consistently uses shorter term technical analysis and market information to enhance its tactical strategy.

Our equity philosophy can be segregated into the following two (2) cycles and their corresponding strategies:

1. STRATEGIC EQUITY STRATEGY (TRACKING MARKET RETURNS)

Most of our equity mandates tend to be benchmark constrained and so our need to master our cyclical tracking error versus corresponding benchmarks over the long term. We do not mind concentrated equity positions in our strategic equity strategy as these positions are driven by fundamental bottom up research. In consequence, these form part of our core equity positioning. As part our strategic equity portfolio allocation, we tend to favour high growth, value companies and where possible, with enhanced income streams.

Some of the key considerations sacred for Anneau in defining high quality strategic equities are : The quality of the shareholders, the board of Directors, the executive management team, the company’s strategy for sustainable growth the execution thereof, unique competitiveness in its products and services delivery versus its competitive landscape.

We finally apply a range of financial filters based on the relative valuation of the company, its price, cash flow robustness and predictability, the growth of its revenues and market segments, its margins and profitability as well as its credit worthiness, where applicable.

2. TACTICAL EQUITY STRATEGY (PURSUING EXCESS RETURNS)

Our tactical equity strategy is more geared towards creating Alpha through short term positions using top-down analysis, macro-economic research and technical analysis. This segment of our equity portfolios trades more frequently. We aim to take advantage of short-term volatility in the market to strengthen or weaken our tactical positions in view of creating risk adjusted Alpha for our equity portfolios.

Bar research and the use of technical strategies including technical charting tools, intuition is a very important part of our tactical equity strategy.

Assuming a perfect market, all public information should already be priced in the current market price of an investment security. Hence, ceteris paribus, the analysis coupled with the portfolio manager’s experience and intuition is critical in positioning against current market consensus and in our humble opinion, the only possible way to derive Alpha against the market.

OUR equity INVESTMENT STYLE

The Relentless Pursuit of Alpha

Irrespective of Market Cycles

Given our multi assets expertise and our need to cater to different types of institutional and retail clients with very different investment objectives and risk constraints, Anneau has developed an equity investment style that blends growth and value investing (across small, mid and large cap companies) in most equity portfolio strategies. Relevant to the investment mandate, a dedicated value and/or growth investment style may also be used.

These Investment styles matter because different styles perform differently at different times during different economic and market cycles. In consequence, they help to reduce the risks associated with investing strategies that perform better or worse in certain market conditions.

Our investment Style fit has predominantly been accentuated towards a BLEND style for Mauritius and Africa, due to the following reasons:

1. The investment guidelines and risk appetite of most of our retail and institutional clients are conservative to moderate and hence the suitability of such a style for them;

2. The capital markets of Africa, including Mauritius being still relatively young wherein a number of the large to mid-caps in Africa, including Mauritius, would else wise be qualified as Small Caps in other larger and more developed markets. For Institutions, the relative liquidity of their underlying investments is very important; and

3. We strongly believe that due to the inefficiencies and mis-pricing in smaller markets like Mauritius, it is important to provide flexibility and improve the markets’ liquidity. Hence the BLEND style embodies well in the local market dynamics, thereby also improving participation in smaller companies whenever the opportunities are attractive.

ASSET CLASSES SPECIFIC PHILOSOPHIES

Learn more about our Investment Philosophy for the multitude of Asset Classes that we invest in.

As Multi Assets Investment Managers, we invest in Publicly Listed Equities, Fixed Income and Alternatives.

Fixed Income

Fixed Income refer to investments in the Debt issued by Mauritian and Sovereign Governments, Supra-nationals and corporate bodies.

Alternatives

Alternatives include Private Equity, Infrastructure, Energy, Real Estate/Property- REITS, Commodities and Hedge Funds.